This election season, The 9th Street Journal is sitting down with candidates to chat about their priorities — over frozen pops.

Our reporter Courtney Lucius spoke recently with Brad Briner, a Republican who is running for state treasurer. The interview has been lightly edited for length and clarity.

Courtney Lucius, The 9th Street Journal: Many voters may not know what the state treasurer does. Why should voters care about this office?

Brad Briner: I would be surprised that there’s 10% of voters who know what the state treasurer does. The state treasurer — I mean, it’s in the name — manages our treasure. So it’s the investments of our state. It’s the big capital items of our state. The job is to protect that treasure and to grow that treasure. They should care, because it’s your treasure. Ultimately, it’s your tax dollars too. What do we do with that treasure? How do we spend it, if we were going to spend it? What do we save it for? You should care, because it’s all the assets of our state.

9th Street: What inspired you to run for North Carolina state treasurer?

Brad Briner: I’ve been ridiculously blessed in my life. I have had an amazing 25-year career in the investment business. I started being interested in the investment business when I was five years old. I’ve always known that I wanted to do this, and it turns out I’m pretty good at it, so I retired at the age of 46. And our state treasurer does that, makes investments for a living. And so I thought about what I could do, how I could use my skills for the betterment of the world. This seemed like a natural fit. So that’s why I’m running for state treasurer.

9th Street: Speaking a little bit more to your past experience, if you’d like to expand. How would that guide you as state treasurer, if elected?

Brad Briner: So I managed money for UNC Chapel Hill out of undergrad. I managed money for large families throughout the Southeast, and then I managed money for Mike Bloomberg, one of the five richest people on Earth. Those experiences give you a capability of managing 125 billion dollars of the state pension plan. We’ve got this simple problem, but with very complicated answers.

The simple problem is our retirees need more money to deal with inflation, and we can’t give it to them. Our state legislature is funding everything we ask. And so how do we solve those problems? It’s by making our investments work harder than they currently do. We’ve made roughly 5% a year for 20 years. We need to make 6.5%. Doesn’t sound like a big difference, but with compound interest on $125 billion, that ends up being billions of dollars of difference for our taxpayers, our retirees and our citizens.

Brad Briner: I have four kids, but I have a 17 year old and a 16 year old daughter, and we’ve just taught them both how to drive. And so the best analogy I have revolves around them. The 17 year old is a bit of a risk-taker. When we got on the freeway, she’d love to go 85 miles an hour. The 16 year old, not so much. She’d like to go 45 miles an hour. These are both problems, and one is probably a little bit more dangerous than the other, but they’re both dangerous. The idea is really to go 60 or 65, and the same thing is true in the investment business.

If you are going too slow, you have obvious implications, like not being able to pay people more when inflation happens. If you’re going too fast, you run different risks that are probably even more dangerous. The trick is to go just the right speed, and that’s 60 miles an hour, 65 miles an hour on the freeway, and it’s 6.5% for our pension. What’s ironic is today, it’s easier than ever to make 6.5% because interest rates are so high, so you don’t have to take heroic risks to do that. My background of doing this for 25 years gives me the experience and the detail to give you a better answer to that question than most people, and certainly my opponent.

9th Street: The North Carolina state healthcare plan transitions to Aetna in 2025 after using Blue Cross Blue Shield for over 40 years. If elected, how would you manage this transition?

Brad Briner: That transition is literally day one for the new treasurer. And so inevitably, when you’re transitioning 740,000 people, something’s going to go wrong, and the new treasurer’s going to get to deal with that on New Year’s Day. So inevitable, but hopefully we will get through it. That transition is not as material as it sounds. What the implication is for the average state health plan member is you’re going to get a new card. It’s going to have a different name on that card. You’re going to go to the same doctor, and that doctor is going to give you the same treatment he or she would have before. But I understand that that is change, and it’s been a long time, as you note. So that scares some people.

There will be, we think, tens, not hundreds or thousands, of doctors or providers who will not participate in Aetna, and so that is going to be a challenge. And for those people who have to make that transition to a new doctor, I have sympathy for them, and we’re going to try to fix that. But by and large, it’s a logistical issue for January 1, followed by trying to convince those few providers who won’t make the transition to make the transition thereafter. The truth is, it allows us to potentially do some things down the line. That change in and of itself doesn’t really solve our problems in the state health plan, it just sets up some potential solutions to those problems.

9th Street: You mentioned your opponent a little earlier. What’s one reason that you would vote for your opponent, and one reason that you wouldn’t?

Brad Briner: Wesley, Representative Harris, is a nice guy. He’s a smart guy. He’s got a PhD. He’s been in the state legislature for six years. So I’d vote for him, I guess, because he has some legislative experience. And again, I have no problem with him as a person. So those are reasons that I’d vote for him.

I think this campaign is a little bit different than most, in that there’s no huge policy differences. If and when you speak with him, you’ll see that we, by and large, say the same things about what we need to do, which means the question is, who’s more capable of doing them? And that’s where I obviously think I have a better case.

9th Street: How has North Carolina’s economy shifted in the last five years? And how do you think that affects you as, potentially, state treasurer?

Brad Briner: So two different things have occurred— one, maybe over a longer period than five years, and one, certainly over the five years. The longer period is the urban-rural divide. We see that every time we go 50 miles from here in any direction. Shorter term, it’s the in migration which is exacerbating the urban- rural divide, and it’s posed a challenge for us. We’ve been number one for business each of the last two years until this year. We fell to number two, still a good place to be. But why? It’s because we’re not investing sufficiently in infrastructure to keep up with that in migration and that growth. So that is a big change for us, because it represents hundreds of thousands of people who are coming here. We should all be proud of that. We should all be happy that people are choosing to move here. But we’ve got to manage that, and we’re not doing the best job that we can right now.

9th Street: If you’re elected, what would you be most excited about coming into office?

Brad Briner: I love the investment business. I get a kick out of it, I get a thrill out of it, I wake up every morning thinking about it. So to me, doing the core job of the treasurer is what I want to do. Actually, on the way over here, a recruiter called me about a job, which I’m not interested in. But should things not work out, I will be in the investment business in some way, shape or form, and so this is what I want to do. I think this role has the most impact for our state and our people. But if not, I’ll find something else in the investment business, I’m sure.

9th Street: And just to round this out, what is a recent book you read, and what stuck out about it to you?

Brad Briner: I read a lot of books. Can I give you two?

9th Street: Sure.

Brad Briner: I read a book called “The Fourth Turning.” And what it deals with is, it’s called generational theory— essentially that every 80 or so years in this country and in other countries, we have existential crises. World War Two, today arguably, Civil War, the Revolutionary War, and you keep going back. Why do these happen every 80, 85 years? And it attempts to answer that question. So it’s fascinating in that regard, because, not that you can make perfect sense of history, but sometimes history does run.

And then the book I’m reading right now is a short history of the Cold War. My 11 year old, for whatever reason, is obsessed with the Cold War, and so I was reading again about the Cuban Missile Crisis and Khrushchev. And in the end, what you learn over and over again is that the rest of the world sits around, and before they do something, thinks, what is the US’ reaction going to be to whatever I want to do? What an amazing position we find ourselves in as a country. What an amazing thing to be true all over the world. I love to read, and I love to understand what’s going on around me, and that book is helping with what I think is going on in the world today.

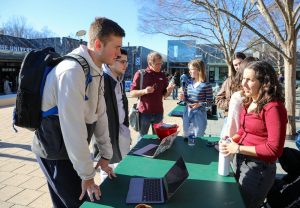

At top, Brad Briner discusses his plans with 9th Street reporter Courtney Lucius. Photo by Kulsoom Rizavi – The 9th Street Journal